The Only Guide for Frost Pllc

Table of ContentsThe Definitive Guide to Frost PllcThe Ultimate Guide To Frost PllcWhat Does Frost Pllc Do?The Single Strategy To Use For Frost PllcGetting The Frost Pllc To Work

Employing a regional Certified public accountant company can positively impact your service's monetary health and success. A regional Certified public accountant firm can aid reduce your service's tax problem while making sure conformity with all relevant tax obligation laws.

Jenifer Ogzewalla I've dealt with CMP for a number of years now, and I've really appreciated their proficiency and effectiveness. When bookkeeping, they function around my routine, and do all they can to preserve continuity of personnel on our audit. This saves me time and power, which is invaluable to me. Charlotte Cantwell, Utah Event Opera & Musical Theatre For a lot more inspiring success tales and feedback from local business owner, go here and see just how we've made a difference for companies like your own.

Here are some essential concerns to assist your choice: Examine if the CPA holds an active certificate. This assures that they have passed the necessary exams and fulfill high honest and professional standards, and it shows that they have the certifications to handle your monetary matters properly. Validate if the certified public accountant provides solutions that straighten with your business needs.

How Frost Pllc can Save You Time, Stress, and Money.

Tiny services have unique economic needs, and a Certified public accountant with relevant experience can give even more tailored guidance. Ask about their experience in your market or with businesses of your size to guarantee they comprehend your specific difficulties.

Clear up exactly how and when you can reach them, and if they provide routine updates or consultations. An accessible and receptive certified public accountant will certainly be indispensable for timely decision-making and assistance. Hiring a neighborhood certified public accountant company is more than simply outsourcing financial tasksit's a wise financial investment in your service's future. At CMP, with offices in Salt Lake City, Logan, and St.

Download and install the free book today to see more information. Below are 8 questions to take into consideration to help you better comprehend whether purchasing a bookkeeping firm is the most effective selection for you. Your answers to these concerns will offer you a lot more insight right into the monetary aspects and purchasing process that you would certainly encounter when getting a practice.

The Basic Principles Of Frost Pllc

It is essential to get a 360-degree sight of the targeted firm in order to make a notified decision. Below are some factors to evaluate: Testimonial client demographics, concentration threats, and retention rates. Frost PLLC. Analyze historical monetary declarations and income trends. Assess credentials, retention prices, and personnel spirits. Examine for any kind of legal or ethical concerns the firm may have encountered.

Identify if the vendor agrees to help post-sale to guarantee a smooth change for team and customers. Determine if the firm's values and job design line up with yours. Make certain the assessment is practical and terms are clear. Gauge future development prospects and market setting. While owning a technique can be financially rewarding and empowering, it includes its obstacles.

Due diligence and comprehending the firm's financials and operations are crucial prior to making a decision. Due diligence is a thorough examination of the CPA firm you're taking into consideration purchasing.

Frost Pllc for Dummies

Evaluate the plans and where added threat administration may be required. Review the firm's data protection, equipment supply and even more. Examine the financial documents, payment practices, and locations where rates could be raised. Confirm the licensing and classifications of the staff, consider any non-compete arrangements, and identify whether their explanation there are any kind of impressive HR problems.

An accountant that has passed the CPA test can represent you before the Internal revenue service. Certified public accountants might function for themselves or as part of a firm, depending on the setting.

records to a firm that concentrates on this location, you not only complimentary yourself from this taxing task, yet you additionally complimentary yourself from the danger of making errors that might cost you financially. You may not be capitalizing on all the tax financial savings and tax deductions offered to you. One of the most essential inquiry to ask is:'When you conserve, are you putting it where it can expand? '. Numerous organizations have executed cost-cutting measures to decrease their total expenditure, but they have not put the money where it can assist the company grow. With the aid of a certified public accountant firm, you can make the most educated decisions and profit-making methods, thinking about one of the most existing, updated tax obligation rules. Government firms in all degrees require documentation and conformity.

Facts About Frost Pllc Uncovered

Handling this responsibility can be a frustrating job, and doing glitch can cost you both financially and reputationally. Full-service certified public accountant firms recognize with declaring demands to guarantee your company follow federal and state laws, click resources along with those of financial institutions, financiers, and others. The rest of the year? They're generally ghosts. Having a CPA firm in your corner throughout the year gives you with fullaccessibility to their expertise. A CPA can provide strategic recommendations and understanding based on financial information, and they have experience with tax planning. Your organization can take advantage of having an expert in financing on hand to help make much better critical decisions when you need it most. Frost PLLC. From our Tennessee offices, we supply different audit solutions for business and individual clients. Getting going takes simply a phone

call; remainder assured your accounts are in the hands of a team you can trust. Call us to find out more about our services. It is necessary to evaluate both the benefits and drawbacks of owning your very own accountancy firm to make a decision if this is the most effective step for you. When you're an entrepreneurin accounting

or any kind of various other industryyou come to be the decision-maker. You no more need to report to your supervisor or comply with others' guidelines( that you may or may not agree with ). Owning your very own firm will require that you put in the added work and make hard decisions, but you'll be the one to choose; and for some, that makes all the distinction.

Neve Campbell Then & Now!

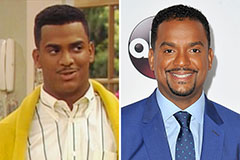

Neve Campbell Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Bug Hall Then & Now!

Bug Hall Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!